Analysis: Evaluation & Results Analysis¶

Introduction¶

Analysis is designed to show the graphical reports of Intraday Trading , which helps users to evaluate and analyse investment portfolios visually. The following are some graphics to view:

- analysis_position

- report_graph

- score_ic_graph

- cumulative_return_graph

- risk_analysis_graph

- rank_label_graph

- analysis_model

- model_performance_graph

All of the accumulated profit metrics(e.g. return, max drawdown) in Qlib are calculated by summation. This avoids the metrics or the plots being skewed exponentially over time.

Graphical Reports¶

Users can run the following code to get all supported reports.

>> import qlib.contrib.report as qcr

>> print(qcr.GRAPH_NAME_LIST)

['analysis_position.report_graph', 'analysis_position.score_ic_graph', 'analysis_position.cumulative_return_graph', 'analysis_position.risk_analysis_graph', 'analysis_position.rank_label_graph', 'analysis_model.model_performance_graph']

Note

For more details, please refer to the function document: similar to help(qcr.analysis_position.report_graph)

Usage & Example¶

Usage of analysis_position.report¶

API¶

-

qlib.contrib.report.analysis_position.report.report_graph(report_df: pandas.core.frame.DataFrame, show_notebook: bool = True) → [<class 'list'>, <class 'tuple'>] display backtest report

Example:

import qlib import pandas as pd from qlib.utils.time import Freq from qlib.utils import flatten_dict from qlib.backtest import backtest, executor from qlib.contrib.evaluate import risk_analysis from qlib.contrib.strategy import TopkDropoutStrategy # init qlib qlib.init(provider_uri=<qlib data dir>) CSI300_BENCH = "SH000300" FREQ = "day" STRATEGY_CONFIG = { "topk": 50, "n_drop": 5, # pred_score, pd.Series "signal": pred_score, } EXECUTOR_CONFIG = { "time_per_step": "day", "generate_portfolio_metrics": True, } backtest_config = { "start_time": "2017-01-01", "end_time": "2020-08-01", "account": 100000000, "benchmark": CSI300_BENCH, "exchange_kwargs": { "freq": FREQ, "limit_threshold": 0.095, "deal_price": "close", "open_cost": 0.0005, "close_cost": 0.0015, "min_cost": 5, }, } # strategy object strategy_obj = TopkDropoutStrategy(**STRATEGY_CONFIG) # executor object executor_obj = executor.SimulatorExecutor(**EXECUTOR_CONFIG) # backtest portfolio_metric_dict, indicator_dict = backtest(executor=executor_obj, strategy=strategy_obj, **backtest_config) analysis_freq = "{0}{1}".format(*Freq.parse(FREQ)) # backtest info report_normal_df, positions_normal = portfolio_metric_dict.get(analysis_freq) qcr.analysis_position.report_graph(report_normal_df)

Parameters: - report_df –

df.index.name must be date, df.columns must contain return, turnover, cost, bench.

return cost bench turnover date 2017-01-04 0.003421 0.000864 0.011693 0.576325 2017-01-05 0.000508 0.000447 0.000721 0.227882 2017-01-06 -0.003321 0.000212 -0.004322 0.102765 2017-01-09 0.006753 0.000212 0.006874 0.105864 2017-01-10 -0.000416 0.000440 -0.003350 0.208396

- show_notebook – whether to display graphics in notebook, the default is True.

Returns: if show_notebook is True, display in notebook; else return plotly.graph_objs.Figure list.

- report_df –

Graphical Result¶

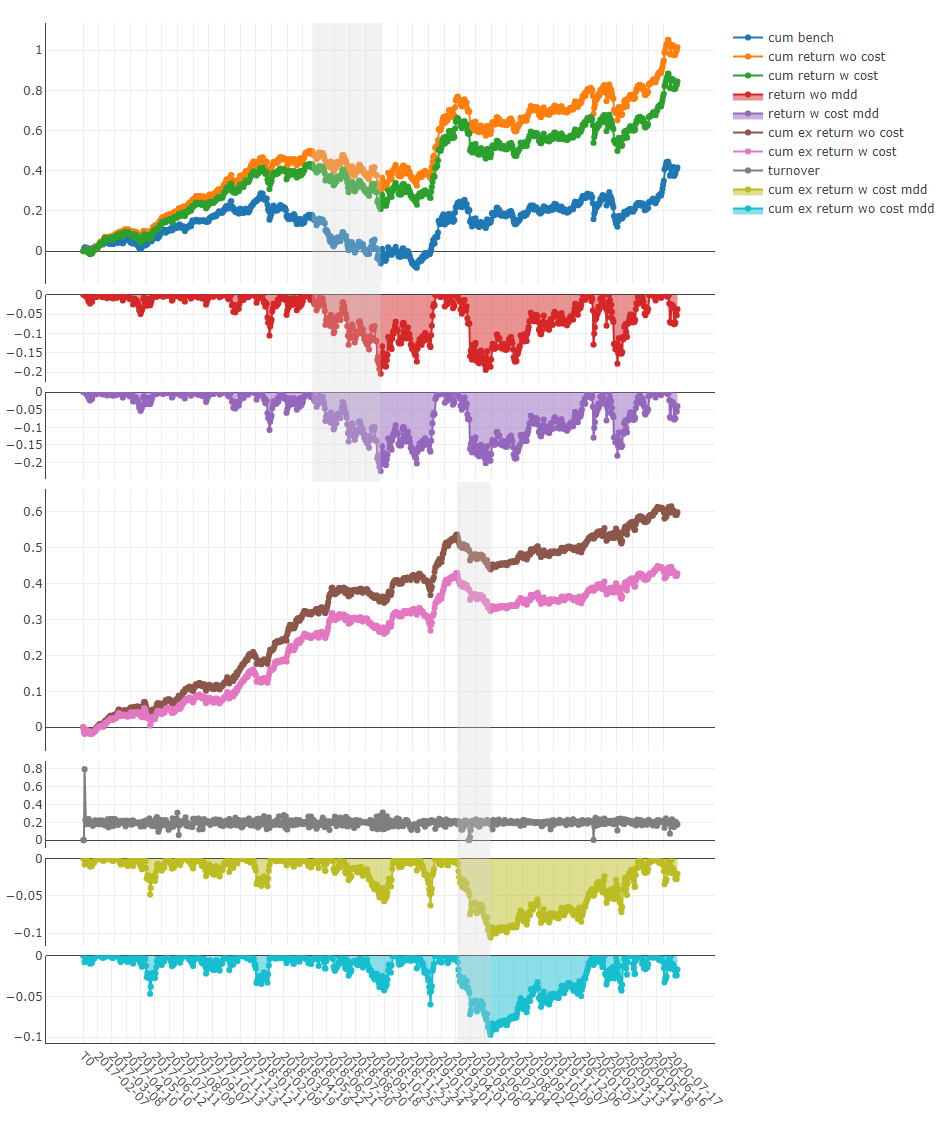

Note

- Axis X: Trading day

- Axis Y:

- cum bench

- Cumulative returns series of benchmark

- cum return wo cost

- Cumulative returns series of portfolio without cost

- cum return w cost

- Cumulative returns series of portfolio with cost

- return wo mdd

- Maximum drawdown series of cumulative return without cost

- return w cost mdd:

- Maximum drawdown series of cumulative return with cost

- cum ex return wo cost

- The CAR (cumulative abnormal return) series of the portfolio compared to the benchmark without cost.

- cum ex return w cost

- The CAR (cumulative abnormal return) series of the portfolio compared to the benchmark with cost.

- turnover

- Turnover rate series

- cum ex return wo cost mdd

- Drawdown series of CAR (cumulative abnormal return) without cost

- cum ex return w cost mdd

- Drawdown series of CAR (cumulative abnormal return) with cost

- The shaded part above: Maximum drawdown corresponding to cum return wo cost

- The shaded part below: Maximum drawdown corresponding to cum ex return wo cost

Usage of analysis_position.score_ic¶

API¶

-

qlib.contrib.report.analysis_position.score_ic.score_ic_graph(pred_label: pandas.core.frame.DataFrame, show_notebook: bool = True, **kwargs) → [<class 'list'>, <class 'tuple'>] score IC

Example:

from qlib.data import D from qlib.contrib.report import analysis_position pred_df_dates = pred_df.index.get_level_values(level='datetime') features_df = D.features(D.instruments('csi500'), ['Ref($close, -2)/Ref($close, -1)-1'], pred_df_dates.min(), pred_df_dates.max()) features_df.columns = ['label'] pred_label = pd.concat([features_df, pred], axis=1, sort=True).reindex(features_df.index) analysis_position.score_ic_graph(pred_label)

Parameters: - pred_label –

index is pd.MultiIndex, index name is [instrument, datetime]; columns names is [score, label].

instrument datetime score label SH600004 2017-12-11 -0.013502 -0.013502 2017-12-12 -0.072367 -0.072367 2017-12-13 -0.068605 -0.068605 2017-12-14 0.012440 0.012440 2017-12-15 -0.102778 -0.102778

- show_notebook – whether to display graphics in notebook, the default is True.

Returns: if show_notebook is True, display in notebook; else return plotly.graph_objs.Figure list.

- pred_label –

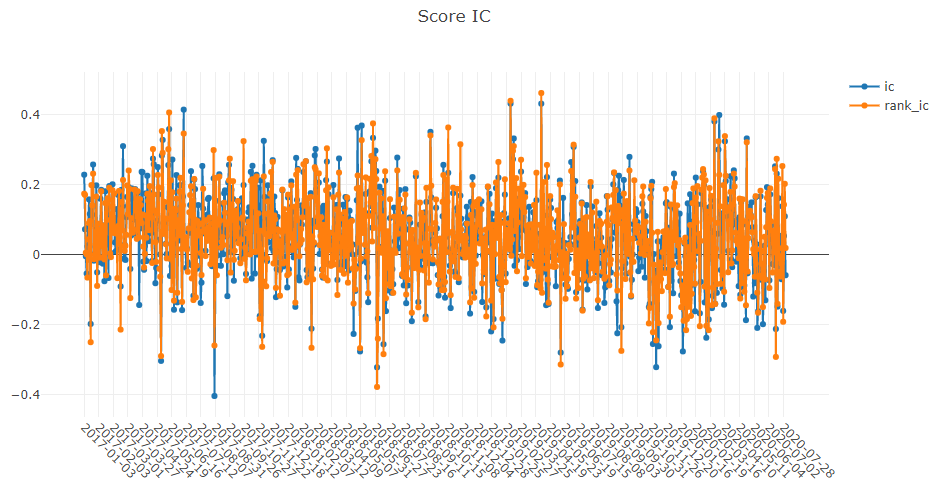

Graphical Result¶

Note

- Axis X: Trading day

- Axis Y:

- ic

- The Pearson correlation coefficient series between label and prediction score. In the above example, the label is formulated as Ref($close, -2)/Ref($close, -1)-1. Please refer to Data Feature for more details.

- rank_ic

- The Spearman’s rank correlation coefficient series between label and prediction score.

Usage of analysis_position.risk_analysis¶

API¶

-

qlib.contrib.report.analysis_position.risk_analysis.risk_analysis_graph(analysis_df: pandas.core.frame.DataFrame = None, report_normal_df: pandas.core.frame.DataFrame = None, report_long_short_df: pandas.core.frame.DataFrame = None, show_notebook: bool = True) → Iterable[plotly.graph_objs._figure.Figure] Generate analysis graph and monthly analysis

Example:

import qlib import pandas as pd from qlib.utils.time import Freq from qlib.utils import flatten_dict from qlib.backtest import backtest, executor from qlib.contrib.evaluate import risk_analysis from qlib.contrib.strategy import TopkDropoutStrategy # init qlib qlib.init(provider_uri=<qlib data dir>) CSI300_BENCH = "SH000300" FREQ = "day" STRATEGY_CONFIG = { "topk": 50, "n_drop": 5, # pred_score, pd.Series "signal": pred_score, } EXECUTOR_CONFIG = { "time_per_step": "day", "generate_portfolio_metrics": True, } backtest_config = { "start_time": "2017-01-01", "end_time": "2020-08-01", "account": 100000000, "benchmark": CSI300_BENCH, "exchange_kwargs": { "freq": FREQ, "limit_threshold": 0.095, "deal_price": "close", "open_cost": 0.0005, "close_cost": 0.0015, "min_cost": 5, }, } # strategy object strategy_obj = TopkDropoutStrategy(**STRATEGY_CONFIG) # executor object executor_obj = executor.SimulatorExecutor(**EXECUTOR_CONFIG) # backtest portfolio_metric_dict, indicator_dict = backtest(executor=executor_obj, strategy=strategy_obj, **backtest_config) analysis_freq = "{0}{1}".format(*Freq.parse(FREQ)) # backtest info report_normal_df, positions_normal = portfolio_metric_dict.get(analysis_freq) analysis = dict() analysis["excess_return_without_cost"] = risk_analysis( report_normal_df["return"] - report_normal_df["bench"], freq=analysis_freq ) analysis["excess_return_with_cost"] = risk_analysis( report_normal_df["return"] - report_normal_df["bench"] - report_normal_df["cost"], freq=analysis_freq ) analysis_df = pd.concat(analysis) # type: pd.DataFrame analysis_position.risk_analysis_graph(analysis_df, report_normal_df)

Parameters: - analysis_df –

analysis data, index is pd.MultiIndex; columns names is [risk].

risk excess_return_without_cost mean 0.000692 std 0.005374 annualized_return 0.174495 information_ratio 2.045576 max_drawdown -0.079103 excess_return_with_cost mean 0.000499 std 0.005372 annualized_return 0.125625 information_ratio 1.473152 max_drawdown -0.088263

- report_normal_df –

df.index.name must be date, df.columns must contain return, turnover, cost, bench.

return cost bench turnover date 2017-01-04 0.003421 0.000864 0.011693 0.576325 2017-01-05 0.000508 0.000447 0.000721 0.227882 2017-01-06 -0.003321 0.000212 -0.004322 0.102765 2017-01-09 0.006753 0.000212 0.006874 0.105864 2017-01-10 -0.000416 0.000440 -0.003350 0.208396

- report_long_short_df –

df.index.name must be date, df.columns contain long, short, long_short.

long short long_short date 2017-01-04 -0.001360 0.001394 0.000034 2017-01-05 0.002456 0.000058 0.002514 2017-01-06 0.000120 0.002739 0.002859 2017-01-09 0.001436 0.001838 0.003273 2017-01-10 0.000824 -0.001944 -0.001120

- show_notebook – Whether to display graphics in a notebook, default True. If True, show graph in notebook If False, return graph figure

Returns: - analysis_df –

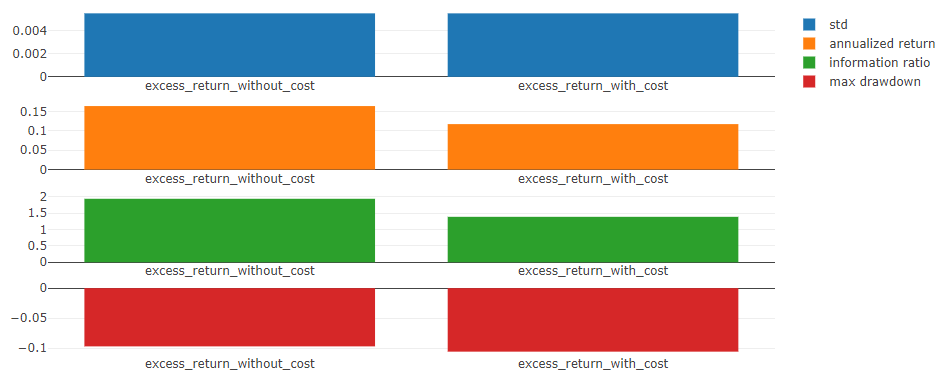

Graphical Result¶

Note

- general graphics

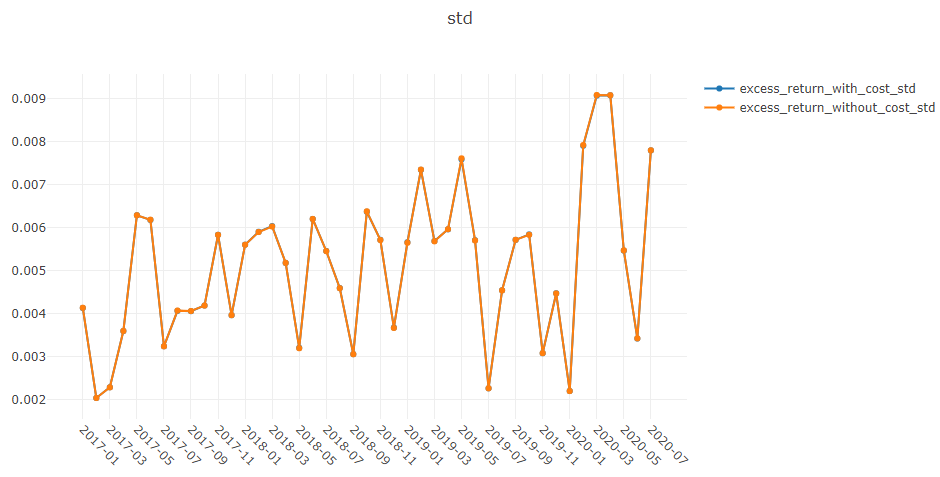

- std

- excess_return_without_cost

- The Standard Deviation of CAR (cumulative abnormal return) without cost.

- excess_return_with_cost

- The Standard Deviation of CAR (cumulative abnormal return) with cost.

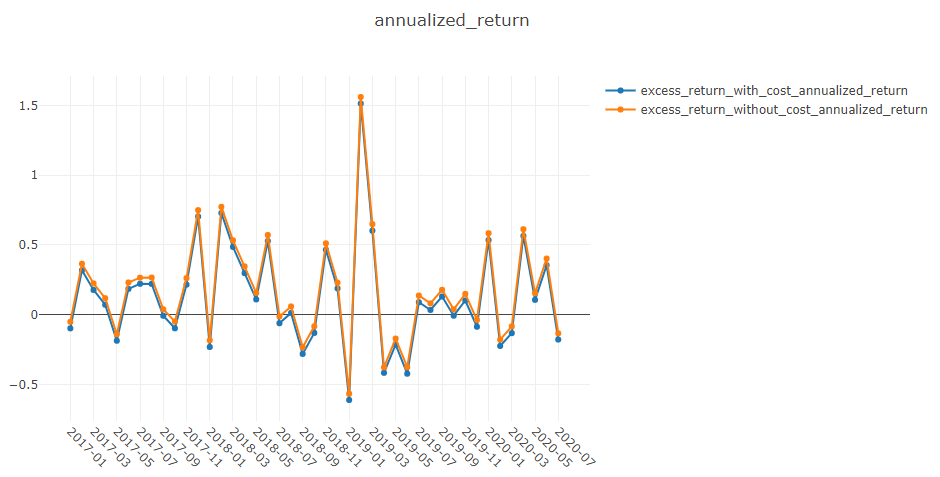

- annualized_return

- excess_return_without_cost

- The Annualized Rate of CAR (cumulative abnormal return) without cost.

- excess_return_with_cost

- The Annualized Rate of CAR (cumulative abnormal return) with cost.

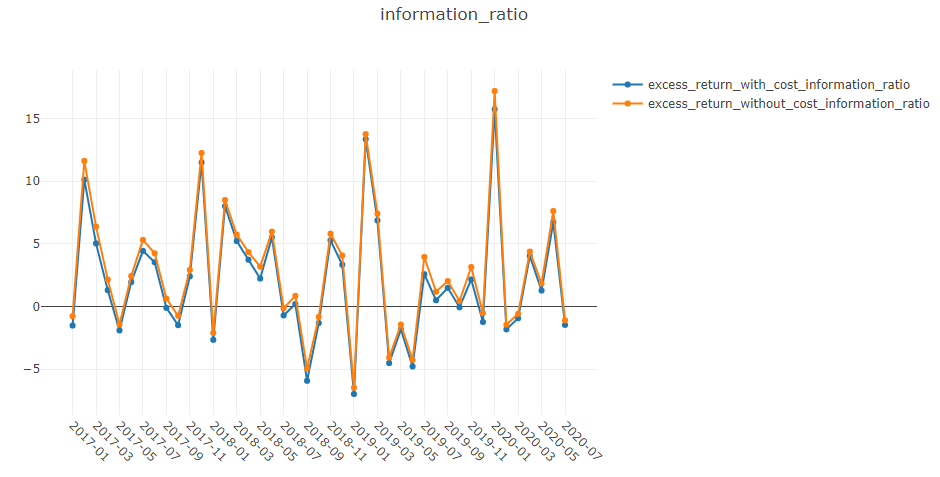

- information_ratio

- excess_return_without_cost

- The Information Ratio without cost.

- excess_return_with_cost

- The Information Ratio with cost.

To know more about Information Ratio, please refer to Information Ratio – IR.

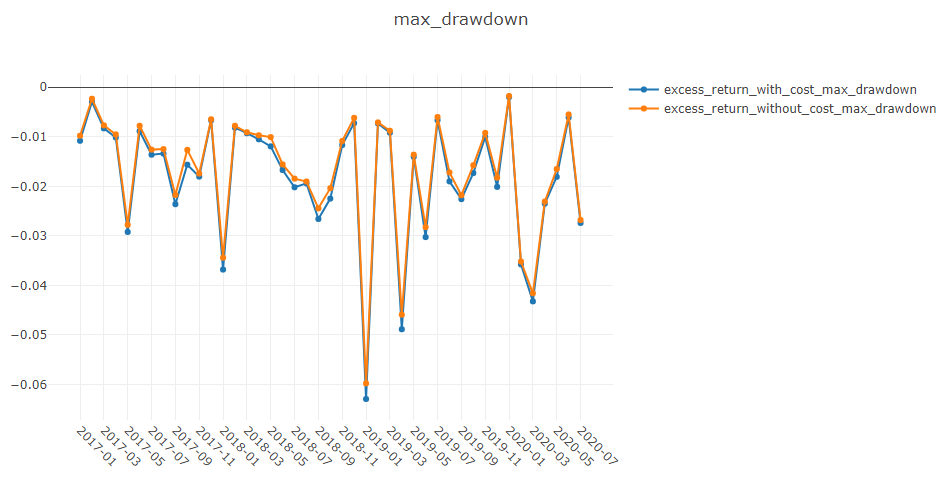

- max_drawdown

- excess_return_without_cost

- The Maximum Drawdown of CAR (cumulative abnormal return) without cost.

- excess_return_with_cost

- The Maximum Drawdown of CAR (cumulative abnormal return) with cost.

Note

- annualized_return/max_drawdown/information_ratio/std graphics

- Axis X: Trading days grouped by month

- Axis Y:

- annualized_return graphics

- excess_return_without_cost_annualized_return

- The Annualized Rate series of monthly CAR (cumulative abnormal return) without cost.

- excess_return_with_cost_annualized_return

- The Annualized Rate series of monthly CAR (cumulative abnormal return) with cost.

- max_drawdown graphics

- excess_return_without_cost_max_drawdown

- The Maximum Drawdown series of monthly CAR (cumulative abnormal return) without cost.

- excess_return_with_cost_max_drawdown

- The Maximum Drawdown series of monthly CAR (cumulative abnormal return) with cost.

- information_ratio graphics

- excess_return_without_cost_information_ratio

- The Information Ratio series of monthly CAR (cumulative abnormal return) without cost.

- excess_return_with_cost_information_ratio

- The Information Ratio series of monthly CAR (cumulative abnormal return) with cost.

- std graphics

- excess_return_without_cost_max_drawdown

- The Standard Deviation series of monthly CAR (cumulative abnormal return) without cost.

- excess_return_with_cost_max_drawdown

- The Standard Deviation series of monthly CAR (cumulative abnormal return) with cost.

Usage of analysis_model.analysis_model_performance¶

API¶

-

qlib.contrib.report.analysis_model.analysis_model_performance.ic_figure(ic_df: pandas.core.frame.DataFrame, show_nature_day=True, **kwargs) → plotly.graph_objs._figure.Figure IC figure

Parameters: - ic_df – ic DataFrame

- show_nature_day – whether to display the abscissa of non-trading day

- **kwargs – contains some parameters to control plot style in plotly. Currently, supports - rangebreaks: https://plotly.com/python/time-series/#Hiding-Weekends-and-Holidays

Returns: plotly.graph_objs.Figure

-

qlib.contrib.report.analysis_model.analysis_model_performance.model_performance_graph(pred_label: pandas.core.frame.DataFrame, lag: int = 1, N: int = 5, reverse=False, rank=False, graph_names: list = ['group_return', 'pred_ic', 'pred_autocorr'], show_notebook: bool = True, show_nature_day: bool = False, **kwargs) → [<class 'list'>, <class 'tuple'>] Model performance

Parameters: - pred_label –

index is pd.MultiIndex, index name is [instrument, datetime]; columns names is [score, label]. It is usually same as the label of model training(e.g. “Ref($close, -2)/Ref($close, -1) - 1”).

instrument datetime score label SH600004 2017-12-11 -0.013502 -0.013502 2017-12-12 -0.072367 -0.072367 2017-12-13 -0.068605 -0.068605 2017-12-14 0.012440 0.012440 2017-12-15 -0.102778 -0.102778

- lag – pred.groupby(level=’instrument’)[‘score’].shift(lag). It will be only used in the auto-correlation computing.

- N – group number, default 5.

- reverse – if True, pred[‘score’] *= -1.

- rank – if True, calculate rank ic.

- graph_names – graph names; default [‘cumulative_return’, ‘pred_ic’, ‘pred_autocorr’, ‘pred_turnover’].

- show_notebook – whether to display graphics in notebook, the default is True.

- show_nature_day – whether to display the abscissa of non-trading day.

- **kwargs – contains some parameters to control plot style in plotly. Currently, supports - rangebreaks: https://plotly.com/python/time-series/#Hiding-Weekends-and-Holidays

Returns: if show_notebook is True, display in notebook; else return plotly.graph_objs.Figure list.

- pred_label –

Graphical Results¶

Note

- cumulative return graphics

- Group1:

- The Cumulative Return series of stocks group with (ranking ratio of label <= 20%)

- Group2:

- The Cumulative Return series of stocks group with (20% < ranking ratio of label <= 40%)

- Group3:

- The Cumulative Return series of stocks group with (40% < ranking ratio of label <= 60%)

- Group4:

- The Cumulative Return series of stocks group with (60% < ranking ratio of label <= 80%)

- Group5:

- The Cumulative Return series of stocks group with (80% < ranking ratio of label)

- long-short:

- The Difference series between Cumulative Return of Group1 and of Group5

- long-average

- The Difference series between Cumulative Return of Group1 and average Cumulative Return for all stocks.

- The ranking ratio can be formulated as follows.

- \[ranking\ ratio = \frac{Ascending\ Ranking\ of\ label}{Number\ of\ Stocks\ in\ the\ Portfolio}\]

Note

- long-short/long-average

- The distribution of long-short/long-average returns on each trading day

Note

- Information Coefficient

- The Pearson correlation coefficient series between labels and prediction scores of stocks in portfolio.

- The graphics reports can be used to evaluate the prediction scores.

Note

- Monthly IC

- Monthly average of the Information Coefficient

Note

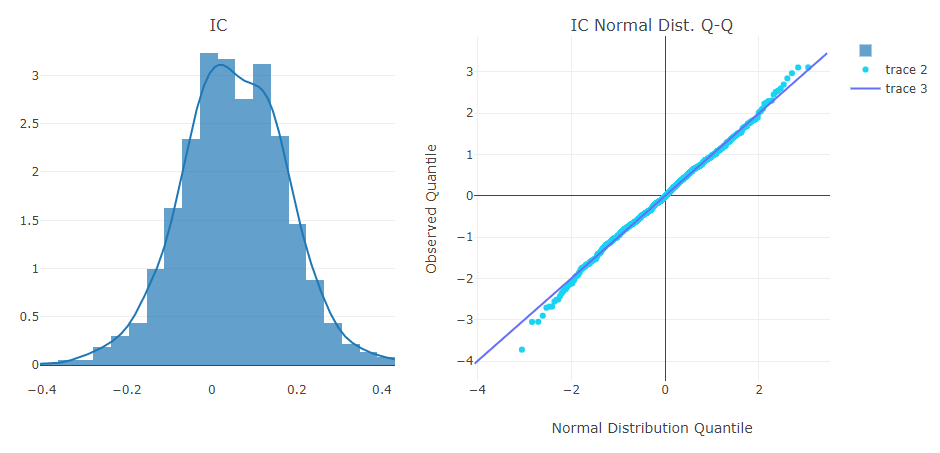

- IC

- The distribution of the Information Coefficient on each trading day.

- IC Normal Dist. Q-Q

- The Quantile-Quantile Plot is used for the normal distribution of Information Coefficient on each trading day.

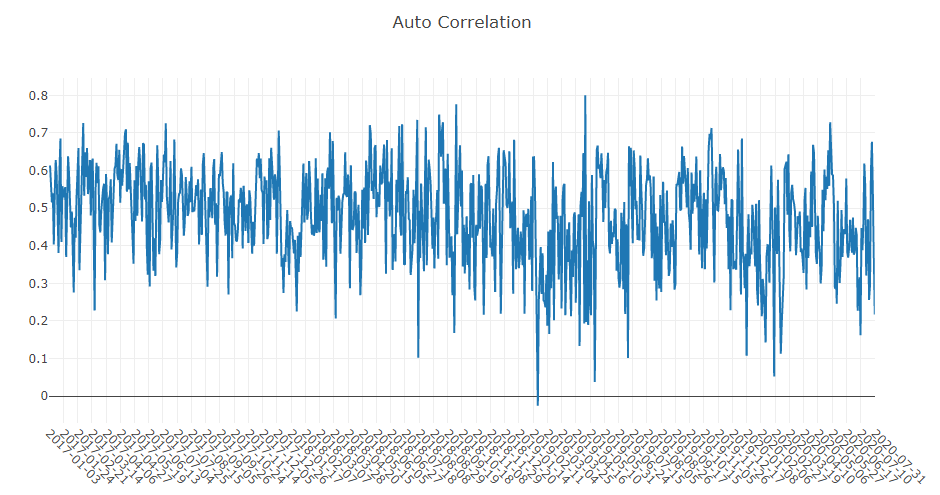

Note

- Auto Correlation

- The Pearson correlation coefficient series between the latest prediction scores and the prediction scores lag days ago of stocks in portfolio on each trading day.

- The graphics reports can be used to estimate the turnover rate.